Quick Summary

Building your dream home now is a fantastic opportunity, especially if it’s something you’ve been considering in the near future. While some might be hesitant due to economic concerns or rising costs, the data suggests that acting sooner rather than later could help you lock in favorable prices, avoid potential future price hikes, and start building equity right away. Historically, interest rates are still in a reasonable range, and material costs, though rising, have stabilized, making now a smart time to start.

Building a new custom home is a major milestone, one that can bring years of enjoyment and value. If you’ve been considering making this move, now is an excellent time to move forward. While it’s normal to feel uncertain due to recent economic shifts, there are several compelling reasons why starting the construction process now could actually work to your advantage.

In fact, if you’re planning to build a custom home, acting now might allow you to lock in current prices, take advantage of historically low mortgage rates, and avoid potential future price increases on materials. Snowden Builders can work with you to build your dream home, using quality materials and the finest craftsmanship.

For three generations, Snowden Builders has constructed premium custom homes for clients throughout Western Michigan. We take a client-centric approach to building, with a focus on open communication and developing a true partnership. We are always happy to answer questions about your house, including questions about material and labor costs that may affect the overall price of your custom home. Reach out today to talk to a member of our construction and design team about your plans for building a new custom home in the Grand Rapids region.

Should I Wait to Build a New House or Build Now?

While the pandemic and its economic aftermath created some uncertainty for building costs, there are still clear advantages to building now. The market for construction materials has stabilized after an initial spike, and interest rates, though slightly higher than in 2020-2021, remain reasonable by historical standards. By starting the building process today, you can lock in your materials and financing at a time when rates are still favorable – a move that could be more cost-effective in the long run.

You also have the chance to begin building equity sooner, setting yourself up for greater financial stability in the years ahead. For these reasons, many homeowners throughout Western Michigan are making the decision to build now instead of later.

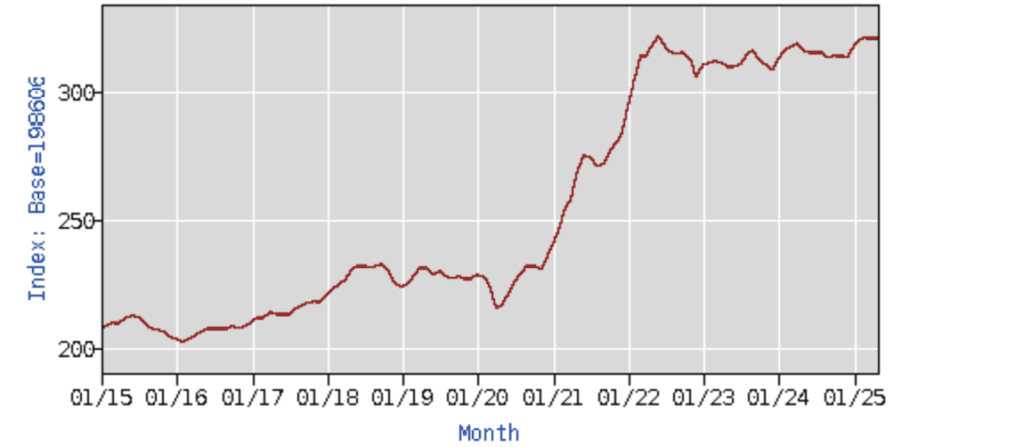

Building Material Costs

As anyone who has been involved in a construction project knows, the cost of building materials has substantially increased over the past 5 to 6 years. In fact, according to a recent Producer Price Index (PPI) from the Bureau of Labor Statistics (BLS), the cost of building materials continues to rise.

The cost of goods represents about 60% of the residential construction inputs price index. While the growth in costs has slowed since a sharp increase between 2020 and 2022, these expenses continue to rise. In 2024, the price of goods used in residential construction grew by 1.7%. From 2023 to 2024, this growth was at 1%.

There are five commodities that have outsized importance for building materials when it comes to residential construction:

- Ready-mix concrete

- General millwork

- Paving mixtures/blocks

- Sheet metal products

- Wood furniture and fixtures

Across these critical commodities, there was price growth for every component except for sheet metal. The price of ready-mix concrete was up by 5.1%, while wood furniture and fixtures increased by 4.3%, general millwork was up by 2.5%, and paving mixtures/blocks increased by 2.3%. The material that experienced the highest growth in pricing in 2024 was softwood lumber, which increased by 14.7%.

Prices for building materials are unquestionably much higher than they were just a few short years ago. The likelihood of these expenses decreasing is low, given historical patterns and the trends over the past 4 to 5 years. While the exponential price growth has slowed, we are still seeing a slight annual increase in costs for necessary inputs like wood, concrete, and other supplies.

For potential homeowners, the upshot of all of this data is that you are unlikely to pay less on building materials in the future than you would right now. If you are contemplating building a new house, then your best option is to start now if you want to lock in lower prices on building materials.

Tariffs Are on Hold

While there has been uncertainty around tariffs, there’s good news: Many of the proposed tariffs that would affect construction materials, like lumber and steel, have been paused. This creates a unique opportunity for you to get started on your home now, without the concern of future price hikes due to new tariffs.

In May 2025, the cost of consumer goods was up 2.4% from May 2024. In June, inflation slowed to 0.1% because the tariffs had largely not taken effect. However, a newly announced steel tariff of 50% may cause prices of certain goods (including metal used in construction and appliances) to increase again.

We don’t know what exactly will happen when it comes to these tariffs and their ultimate impact on the construction industry. What we do know, however, is that we seem to have a temporary reprieve from the tariffs. If you are considering building a new home, starting the process now and purchasing the materials before the prices go up may be a smart idea.

Interest Rates Remain Flat

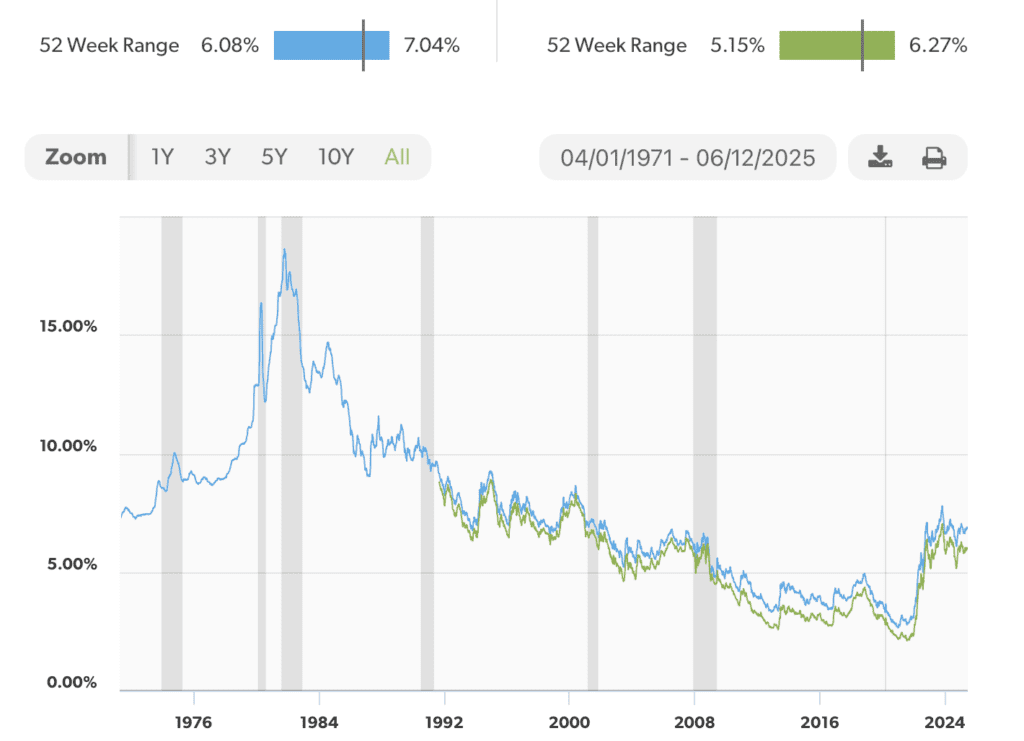

If you are into financial news, then you have likely followed closely as the Federal Reserve has raised interest rates over the past 2 to 3 years to combat pandemic-related inflation. It’s true that mortgage rates are higher than during the pandemic’s record-low period, but even at the mid-to-high 6% range, they are still below historical averages.

Freddie Mac has tracked mortgage rates since 1971. This data shows that while mortgage rates are currently double their all-time low of 2.65% in January 2021, current rates are below the historical average. In fact, between April 1971 and June 2025, the average interest rate for a 30-year fixed-rate mortgage was 7.71%

In the 1970s, when Freddie Mac began tracking these numbers, interest rates were high due to inflation. By 1979, interest rates averaged 11.20%.

In the 1980s, interest rates in the United States soared to an all-time high of 16.64%. This number was due to continued inflation, with the Federal Reserve raising interest rates to bring inflation down. By the 1990s, interest rates declined to a low of 6.91% in 1998 due to an overall stronger economy.

In the 2000s, interest rates were affected by the subprime mortgage crisis. Typical interest rates in the 2000s were around 8%. By 2010, action by the Federal Reserve brought interest rates down to around 5%.

These interest rates stayed low, in the 3 to 5% range, throughout the 2010s. These rates dropped to under 3% during the COVID-19 pandemic. As the country crawled out of the pandemic and attempted to address inflation, interest rates rose.

Current interest rates are higher than they have been since the early to mid-2000s. However, they are still well within the historical average for interest rates. Interest rates are predicted to remain steady at 6 to 7% through 2025.

There are several factors that affect mortgage rates, including the demand for housing, inflation, the actions of the Federal Reserve, the bond market, and overall economic conditions. Interest rates are also dependent on factors like individual credit score, debt-to-income ratio, and the amount of money that you need to borrow. Given the economic uncertainty in the U.S. and the potential for inflation due to tariffs, there is a possibility that in 2026 and beyond, interest rates may rise again.

While no one can predict exactly what rates will do in the future, securing a mortgage now means you can lock in a competitive rate before potential future increases. And if rates do drop in the future, refinancing options will allow you to adjust accordingly.

Growing Equity in Your Home

One of the greatest benefits of building a custom home is the opportunity to grow equity right away. Homeownership is an investment not just in a place to live, but in your financial future. By starting the process today, you begin to build long-term wealth through equity and gain access to the stability and tax advantages that come with owning a home.

While each homeowner has to make the decision that works best for them and their finances, if you know that you want to build a custom home, then now is the perfect time to get started. Once your home is complete, you will be able to build equity in it over the coming years. With prices, inflation, and interest rates potentially rising, it is a good idea to start the home-building process now rather than waiting. Our team can help you with the process, including advising you on smart ideas for increasing the value of your new home.

Considering Building? Speak With A Professional West Michigan Builder

Choosing to build your home today can be a strategic move that helps you avoid rising costs, secure favorable interest rates, and start building equity in your property. With the guidance of an experienced builder like Snowden Builders, the process can be seamless and exciting. Don’t wait for future uncertainties, start building your dream home today!

Snowden Builders has earned a reputation for excellence in home construction in Western Michigan. We build luxury custom homes throughout the region, working collaboratively with our customers to help bring their dreams to life. If you are thinking about building a custom home in Michigan, give us a call at 616-532-1800 or fill out our online contact form to get the process started.

Written By David Kranker In Collaboration With Snowden Builders

David has written and covered topics within the construction and building industry for over half a decade. When not writing, David can be found working on building projects of his own at his residence or rental properties. David has worked on a wide variety of building projects from basement finishing to bathroom remodels, and MEP installation and interior finishes for new builds.